MOKA IS HELPING MSME WITH THE EASE OF DIGITAL CASHIER

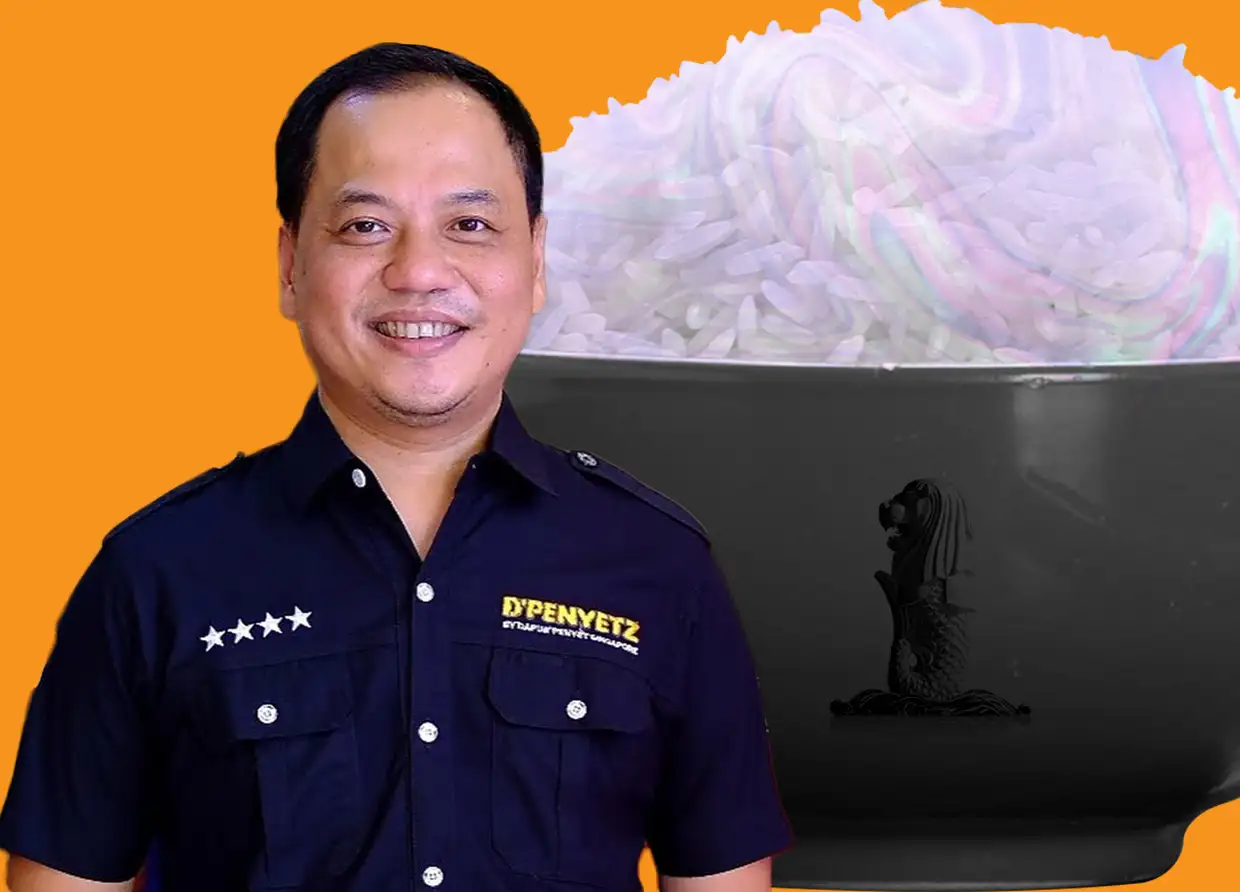

Haryanto Tanjo supports MSMEs with Moka's digital cashier solutions

Taking advantage of underserved markets is the best method to uncover new economic niches. Fred Smith first reasoned, "Why can't a letter or parcel arrive at its destination overnight?" This question was essential in his success in launching Federal Express (FedEx).

Similarly, CEO and Co-Founder Moka Haryanto Tanjo saw that there were over 60 million MSMEs in Indonesia that were not served by banks, let alone digital-based financial business services. From this arose the concept of launching a new market with a product called Moka.

MSMEs in underdeveloped areas continue to manage their businesses manually without any cashier system and financial reporting. The University of California, Berkeley graduate had previously run a clothing e-commerce company in San Francisco and personally controlled its sales. Haryanto couldn't afford a typical point-of-sale (POS) system because it was so new at the time and cost thousands of dollars.

View this post on Instagram

He mulled over the idea of developing an integrated payment solution with mobile POS that could be used by numerous business sectors in Indonesia. The mPOS system was designed to be quick and simple to use, so that even a cashier or a new restaurant or coffee shop manager can utilize it. Its backoffice is packed with features.

All data, including menu items, quantity of items, payment transactions, monthly or annual sales reports, order methods, payment methods, stock, membership, transaction summaries, and customer feedback, may be arranged by business owners using their mobile phones and tablets.

According to the master's graduate of UCLA Anderson School of Management, there are three major difficulties that MSMEs face if they continue to manage their businesses manually. First, manually written financial reports, such as recording receipts, requires not only a massive amount of time, but the data is also not always accurate.

Second, the manual approach does not allow MSMEs to adequately manage their inventory stock management in order to reduce turnover. Third, the manual system generally only accepts cash transactions, whereas the contemporary payment system accepts debit or credit cards.

MSME actors that want to accept debit or credit card transactions from clients or customers will undoubtedly require a bank's electronic data capture (EDC) system. Submission to the bank requires time and complete data, particularly for MSMEs, which must be in the form of a business entity, CV, or PT. This is undoubtedly an impediment for the vast majority of Indonesian MSMEs with small business scales.

"We identified the needs of MSMEs in order to help them grow their businesses. They actually require a payment solution, which is how the Moka concept was born," Haryanto said.

Moka as an enabler

Moka is a mobile point-of-sale (mPOS) firm that offers solutions to MSMEs that lack the resources or investment to implement a digital finance system. This Jakarta-based start-up offers a convenient solution for MSMEs, allowing them to transact online in real time anywhere and at any time by just using a mobile phone or tablet as a terminal.

Moka employs cloud-based technology, allowing business actors to gain immediate online access to sales data. A store manager, for example, can monitor all sales transactions at all outlets without having to visit or leave the head office. Businesses can also accept debit and credit card payments using the mPOS solution.

Moka has clients from a variety of industrial industries, which are broadly classified into three business domains. First, there are coffee shops, fast food restaurants, bakeries, and food trucks. Second, there are retailers such as beauty and fashion stores, hobby stores, and bazaars. Third, service industry players such as salons and spas.

The mPOS program, which is integrated with mobile phones, tablets, printers, and backoffices, handles all transactions and records. Simply download the mPOS application on their mobile or tablet, create an account at www.mokapos.com, and people can begin selling. Customers or consumers just insert their credit card into the mPOS terminal, and the amount due is deducted promptly.

The mPOS machine works in the same way as the bank EDC machine with which Moka is now collaborating with Bank Mandiri. Within three days, the transaction money from the consumer or customer is transferred directly to the company's or business actor's account. The digital reporting mechanism for mPOS is also extensive.

Moka makes money by charging a monthly subscription fee of IDR 250 thousand to app users. Users must only pay for one account, however it can be used for multiple stores or business branches.

Moka also deducts a commission from every credit card transaction on the mPOS system that displays the Mastercard or Visa logo. The discount is 2.2 percent per transaction for MSME actors who do not yet have a Trading Business License (SIUP) and Company Registration Certificate, or 2.7 percent per transaction for MSME actors who do not yet have a Trading Business License (SIUP) and Company Registration Certificate (TDP).

"This commission discount is quite tiny when compared to the typical 30 percent increase in turnover of MSME players that use mPOS at this time," said Haryanto.

Since its inception in August 2014, Moka, which employs just up to 50 employees in human resources (HR), has assisted over a thousand SMEs in Jakarta and Bandung. More than 70 MSMEs in Bali have used mPOS.

"This year, we intend to expand further in other locations where MSMEs want solutions," Haryanto said.

Moka collaborated with the operator Telkomsel. According to Haryanto, cloud computing necessitates that all data be connected online to the back office and Telkomsel is the best partner because its network is the most extensive and quickest in Indonesia.

#THE S MEDIA #Media Milenial #moka #digital cashier from indonesia